Monday Market Recap: July 6, 2020

Market Recap

Highlights

Employment data improves as we reach a 11.1% unemployment rate for June, further expanding recovery as businesses continue to reopen.

Supplemental unemployment income under the CARES act set to expire this month pending a new deal from Congress.

Household spending on goods and services rose a record 8.2% in May, however spending remains 12% below February levels.

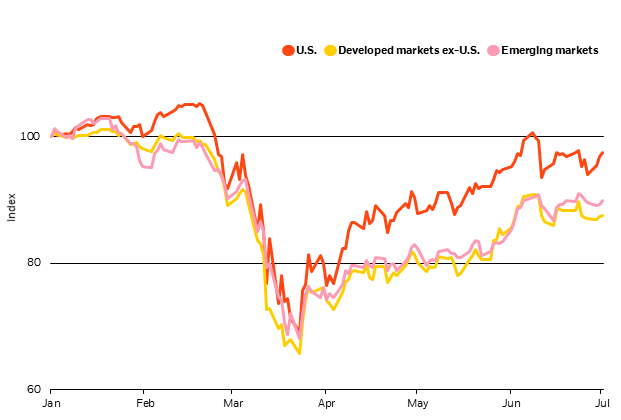

U.S. stocks have outperformed the rest of the world in 2020, with a sharper recovery from the bottoms of late March (see chart below). Yet we are lagging in the department of COVID control. New COVID-19 cases in the U.S. have been surging, prompting some states to roll back or pause their re-openings. We currently sit at #1 in the world with the most confirmed cases at 3 million and over 130,000 deaths. This is potentially setting the U.S. on a very different activity restart path than most Western countries and much of Asia. Whether or not governments reimpose lockdowns, individuals may respond by reducing their mobility – as we observed at the onset of the pandemic. As a result, failure to contain the virus may threaten America’s ability to restart for an extended time.

While we lead the world in confirmed cases, the out performance of U.S. stocks in recent months has largely been supported by another leading category as well: policy response. The U.S. has so far delivered coordinated fiscal and monetary support to offset the initial shock from the pandemic and spillovers to the full economy. However earnings from companies are still expected to fall. Earnings per share of the top 500 corporations are expected to decline 44% in the second quarter from a year earlier. That follows a 12.7% fall in the first quarter. Consensus estimates suggest U.S. corporate earnings will return to their 2019 levels by 2021, but this can be further delayed given the likely slower restart. Renewed U.S.-China tensions and a looming presidential election with a historically wide gap between parties on policy can further add to the uncertainty.

The U.S. market has a high concentration of quality companies – especially in technology and communication services – that are set to benefit from trends accelerated by the pandemic. The resurgence of COVID-19 cases in the U.S. threatens the restart of activity, and has prompted a slight shift from US equities to Europe due to its public health measures and ramped-up policy response.

What I’m Reading – The New Normal of Everyday Life

Stores may be open, but it is far from “business as usual.” The WSJ provides an inside look at how offices, stores, and restaurants are changing as a result of the pandemic. We could see staggered arrival times to work, mandatory sanitized returns, and limited walk-in service for indoor spaces. It is difficult to see exactly what changes are permanent or merely just temporary, but what we do know for certain is that businesses everywhere will have to find creative ways to construct our “new normal” from the ground up.

What I’m Watching - Tim Harford: Trial, Error and the God Complex

Without a plan, it can sometimes be difficult to see the way forward and result in a spiral of uncertainty and self doubt. However in this Ted Talk, Tim Harford argues that being comfortable in uncertainty can actually lead to great innovation. It is hard to admit that we don’t know all the answers, but some of the best innovations in human history have been a result of trial and error, not a perfectly executed plan. Harford’s message seems relevant for these times as we try to figure out solutions to complex problems that we still do not yet fully understand.

What I’m Listening To – Tribe Of Mentors

Tim Ferriss recently released the audiobook version of his bestseller: Tribe of Mentors. A compilation of wisdom from more than 100 of the world’s top performers. What is their daily routine? How did they become successful? How do they think about success and their role within it? In this podcast, he plays the first chapter as well as excerpts from Naval Ravikant, Susan Cain, and Yuval Noah Harari. The podcast provides a glimpse into the lives and philosophies of highly intelligent people that is well worth the listen.

Quick Take – Ascend Invest

Two months ago we launched Ascend Invest with the goal of making professional financial advice accessible to everyone. Over that time we have attracted dozens of users with over $200,000 in assets, many of whom are entering the world of finance for the very first time.

To make this possible we teamed up with an incredible technological partner called Betterment. Together this allows us to provide expert advice and top tier portfolios without any account minimums for 0.85% per year.

After creating an account with Ascend, our technology handles the rest. Including automated rebalancing, trading, and tax loss harvesting. We are very excited to share Ascend Invest with you all here!

Quote of The Week

"When you fly to the moon you don't need a rocket. You just need the imagination"

- Anthony T. Hicks