Avoiding Bad ETFs

In 2008, US investors held approximately $530 Billion in ETFs. As of mid 2021 that number is now over $5 trillion. ETFs have become a staple of investor’s portfolios for their simplicity, low cost, tax benefits, liquidity, and accessibility. An exchange traded fund (ETF) is a bundle of investments that trade on an exchange like a stock. There are over 2,000 ETFs on US exchanges and many different types. Some common types include: Market ETF’s (designed to track a particular index like the S&P 500), Bond ETF’s (designed to provide exposure to different types of bonds), and Actively Managed ETFs (designed to outperform an index rather than simply track it).

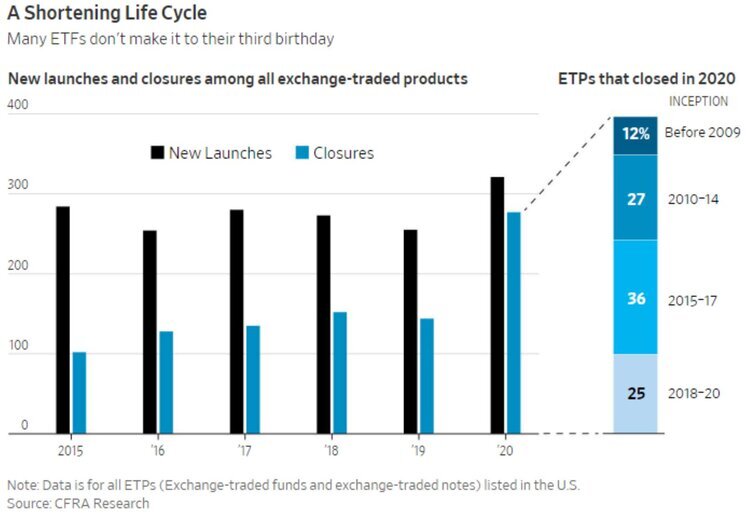

The rise in popularity of ETF’s has been accompanied by a rise in the number of ETF’s available for investors to buy. However, not all of these new ETFs are high quality. According to a study conducted by CFRA research, 277 exchange-traded products shut down in 2020, one-quarter of them had been trading for less than three years. These newly launched ETF’s struggle to compete on fees with more established ETF providers like Charles Schwab or Vanguard group and attempt to capture investor attention through fast growing and sometimes unproven trends. See the chart below:

What can you do to avoid investing in a bad ETF?

Age: Investopedia recommends to look for ETF’s that have been established for over 3 year minimum, but preferably over 5 years.

Level of assets: Expert’s common threshold of minimum assets for an ETF should be at least a few hundred million and ideally $1B or more.

Trading activity: Typically the trading volume is a good indicator of high turnover. Higher trading volume may indicate continuous buying and selling out of positions and trends rather than a buy and hold.

Underlying index or asset: ETFs that aim to track a large index are most likely going to be safer than ones that aim to beat the market or are following a new and unproven trend. Make sure that the underlying asset or index of the ETF you choose is consistent with your investment strategy.

Other common metrics: Check the metrics of the companies that make up the ETF such as P/E ratio, P/B ratio, D/E, and PEG ratio. These metrics, in narrow focused ETFs, can help determine if the companies are overvalued or if it is following a particular trend. If the ETF tracks an index, check its tracking error, this will tell you how closely the ETF has historically matched the index.

Sources: Wall Street Journal, Investopedia, Nerd Wallet, CNBC

——————————————————————————————————————

Hardy Capital Investments is a registered investment advisor. Information provided on these sites is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product. Advice may only be provided by Hardy Capital Investments's advisory persons after entering into an advisory agreement and providing Hardy Capital Investments with all requested background and account information.

If you have any questions regarding our policies, please Contact Us at contact@hardycap.com